MCapital is a non-banking finance company, which is into the lending business. They wanted to build a loan origination system which would be fully digital and could lead to loans being originated without any offline intervention.

LOCATION:

Mumbai, India

DURATION:

2021 - Continuous

TECHNOLOGIES USED:

.NET Core, DevOps - Jenkins, Angular, iOS - Swift, Android - Java & Kotlin

TITLE

MCapital is a non-banking finance company, which is into the lending business. They wanted to build a loan origination system which would be fully digital and could lead to loans being originated without any offline intervention.

PROBLEM STATEMENT

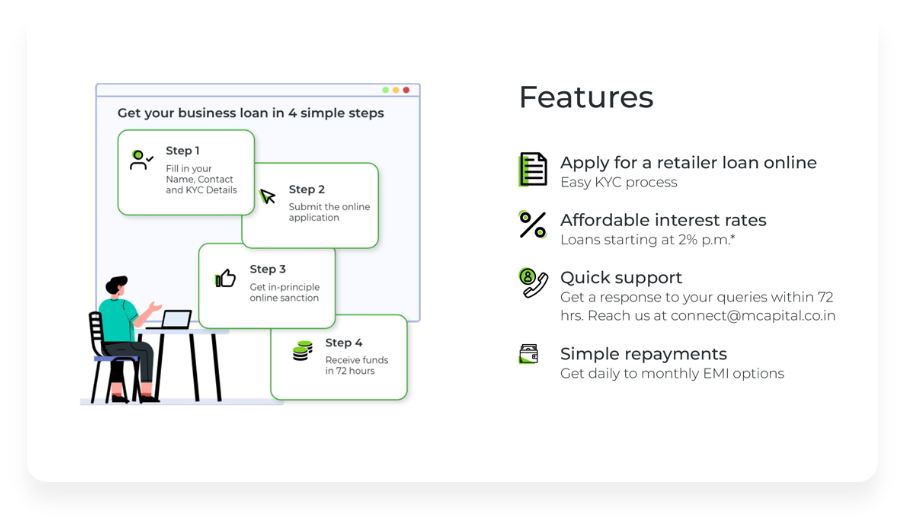

This was a greenfield project where we had to design and develop the entire platform from scratch. This project was launched just before the Covid wave started, and hence a big requirement was to be able to complete the entire loan application journey without any offline intervention.

The client asks were

- For the UI / UX to be completely idiot-proof.

- And that the entire journey be completed online.

- The platform was built to be able to handle spikes in transaction volume.

Since this was a greenfield project, it was important to architect the code in such a way that we would be able to accommodate future iterations/pivots based on market feedback.

OUR SOLUTION

For MCapital, the project solution started from the prototyping phase. The team created the prototypes first using Adobe XD.

A few sample screens from the prototype are showcased below:

Post the prototyping phase the team moved into the delivery phase, the platform consisted of the following components

- .NET core-based services for the REST APIs

- Android, iOS & Angular (mobile first) based frontends where the end user could complete the entire loan application.

- For the database engine, we chose PostgreSQL.

The .NET core services were structured using CQRS (command query responsibility segregation) as a core design pattern, we also used Entity framework along with the repository pattern allowing us the development ease whilst being able to use stored procedures or prepared statements as a fallback whenever we needed to optimize certain parts of the code.

To ensure that we are able to automate all aspects of the loan application journey, we integrated several 3rd party partners like

- KYC / KYB providers

- Identity providers (PAN & Aadhar card).

- Bank statement analysis providers

- e-Agreement providers

- The credit bureau (we integrated with Experian & CIBIL)

- And a few others…

For deployment, we used AWS & Jenkins to take care of the automation around deployment.

DURATION

The initial build of this project was done in 6 months. Post which this project was handled under our "Managed Services" business unit, hence the arrangement is on a continuous basis. What we have achieved for them is a captive team of engineers working at 100% commitment to take care of product iterations/changes as the market provides feedback.

RESULT

The result of this project was that our client was able to launch a whole new business line on the basis of the product we developed for them.

Also because of the adherence to SOLID design principles & CLEAN architecture, as anticipated the product did receive a lot of feedback from the market leading to several iterations.

1

Quick go to market

2

Stable codebase open to extension as per future market feedback.

3

A platform capable of handling huge transaction volumes.

HOW LOGICLOOP TECH BECOMES

YOUR UNDUE ADVANTAGE